Access Online Managing Account Profile User Guide

| Site: | Access Online Learning |

| Course: | Instant Card |

| Book: | Access Online Managing Account Profile User Guide |

| Printed by: | Guest user |

| Date: | Saturday, February 14, 2026, 10:48 PM |

Description

The credit limit and available credit on your managing account determine the amount that your organization has available for issuance of cards. If you have a prefunded account, you can make a payment in order to increase the available amount for card issuance. Use the Managing Account Profile user guide for steps on how to look up the information in Access Online. Call your Account Coordinator for assistance if needed.

Introduction

You can easily view information about the managing accounts in your program using the managing account profile.

You can view information about a managing account, including the following:

Demographics: Provides the name and address of the person responsible for the managing account.

Account information: Provides the hierarchy numbers and cycle date.

Extract information (if applicable): Provides payment extract information.

Default account codes: Provides an accounting code, including any assigned accounting validation controls (AVCs) and/or alternate accounting codes (AACs) that applies to all card accounts rolling up to the managing account.

Authorization limits: Provides credit limit, available credit, any velocity limits and any merchant authorization controls.

Financial history: Includes current and historical payments, credit limit and current balance information.

Additional resources

Access Online offers you several tools to monitor and manage your managing accounts, including:

Managing account statement. You can access your managing account statement. The statement generates the night of the cycle date and is available the next day for you to view in Access Online. You can get an email alert when your managing account statement is available. Refer to the Managing account statement user guide.

Payment options. You use your managing account to make payments. We offer multiple payment options. Consult with your relationship management team to discuss options. You can pay online using Account Pay. Refer to the Account Pay quick start guide for more information.

Managing account setup and maintenance. You may be able to create and maintain your own managing accounts. For information, refer to the Managing account setup and maintenance user guide.

Managing account approval and certification. U.S. Federal government users can also refer to the Managing Account Certification (Pay and Confirm) user guide for information on certifying a managing account in the pay and confirm model. They can also refer to the Managing account approval status report user guide.

Managing account summary and links

The managing account profile provides information about a managing account. The information in this area of the system is view only.

To access the managing account profile:

GO TO Open the Accounts menu, select Managing and select Managing account profile.

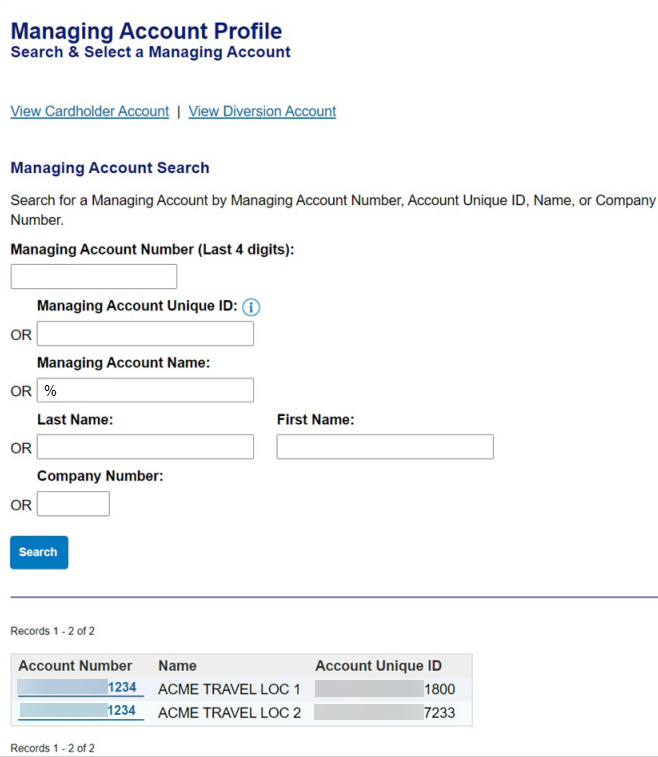

The Search and Select a Managing Account screen displays if you have access to more than one managing account. If you only have one managing account, then the Managing Account Summary screen for that account displays.

Specify search criteria. To display results of all managing accounts you can access, type % in the Managing Account Name field.

Click Search.

Click the account number link for the managing account you want to view.

Managing account summary

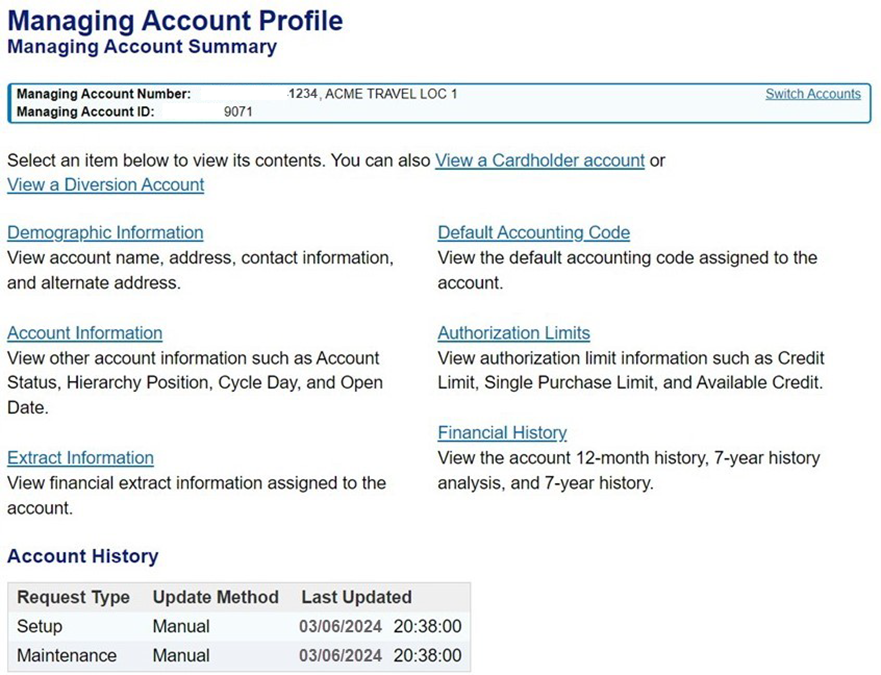

The Managing Account Summary screen displays.

The account number, name and account ID display at the top of the screen. If you want to view a different account, click the Switch Accounts link at the top right of the screen to go back to the Search and Select a Managing Account screen so you can select a different account.

Click any link on the Managing Account Summary screen to view managing account detail. Links include Demographic Information, Account Information, Extract Information, Default Accounting Code, Authorization Limits and Financial History. Information is view only.

The Account History area displays the date and time of the last maintenance activities on the account.

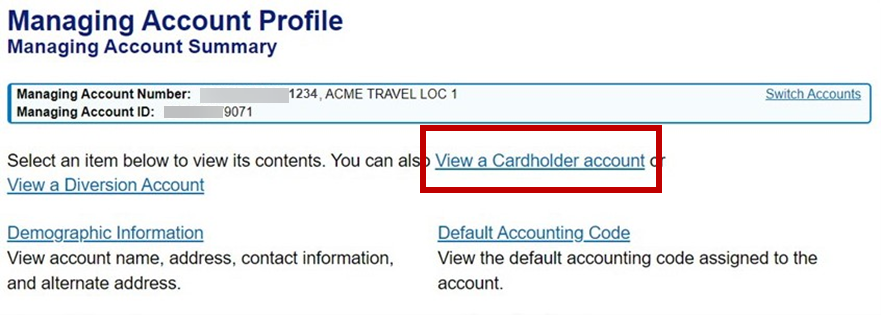

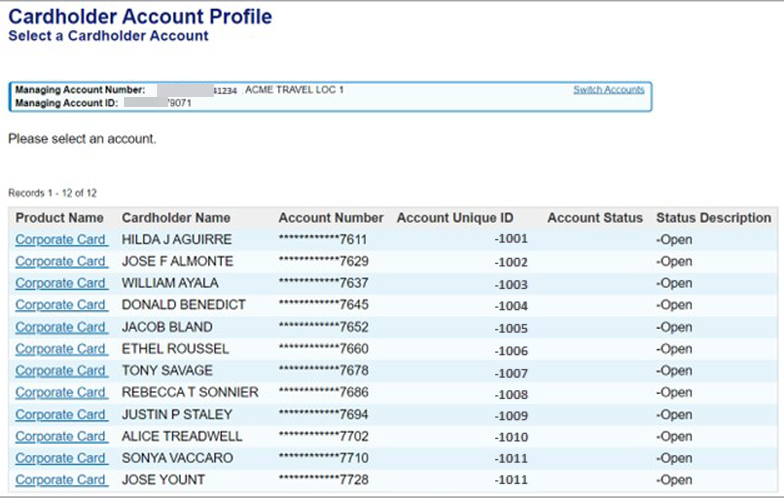

View cardholder account list and profiles

This is a different process from viewing managing account information. This process allows you to use the managing account to drill down and see cardholder account information for the cards that roll up to this managing account.

Click View a Cardholder account to go to a list of cardholder accounts for this managing account.

The Select a Cardholder Account screen displays with a list of cardholder accounts for this managing accounts.

Locate a cardholder name and click the product name link on the same line to access the cardholder account profile.

See the Cardholder account profile user guide for more information about cardholder account profiles.

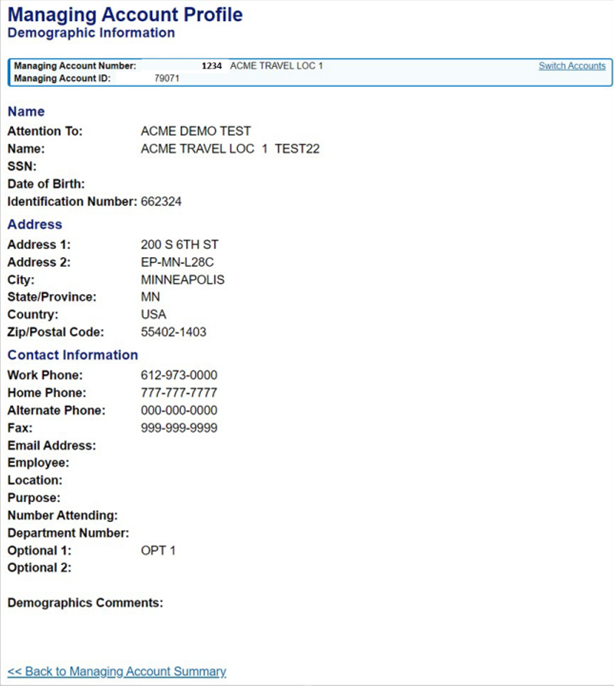

Demographic information

The Demographic Information screen provides the name, address, phone number, email address and other information of the person responsible for the managing account.

If anyone added comments during account setup or maintenance, those comments display here.

Click Back to Managing Account Summary from any screen.

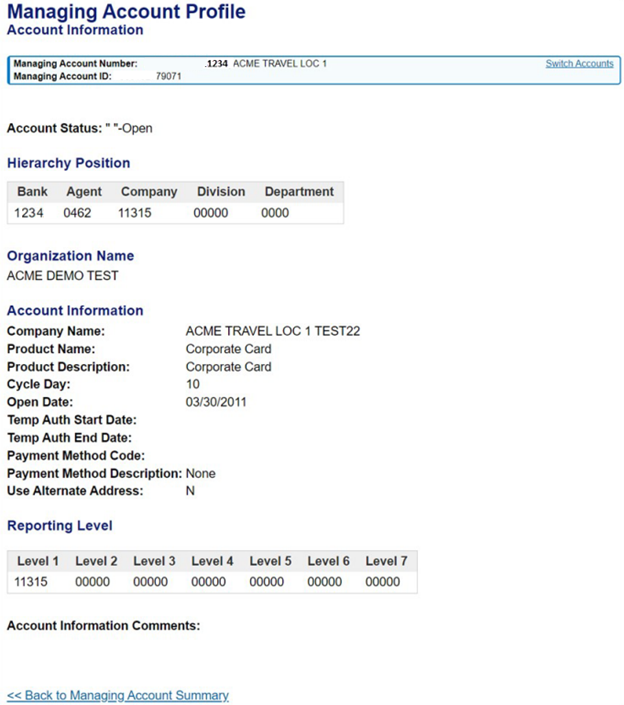

Account information

The Account Information screen displays specific information about the account, including the following:

Account status. Identify whether the account is open or closed.

Processing hierarchy position. This number is used for looking up reports, creating card accounts and other tasks.

Organization name. This displays as the second line of embossing on the card account. You can change this on the cardholder account setup screen if desired.

Company name. This is the name of the managing account.

Product name and description. This identifies the type of product, such as purchase, travel or One card or other product type.

Cycle date. The account statement generates the night of the cycle date and is available for viewing in Access Online the next day. If the cycle date falls on the weekend or holiday, then the statement generates the night of the next business day and is available for viewing the next day. If this field says 99, the cycle date may be the last day of the month or another setting; contact the bank if you need clarification.

Open date. This is the date the account was opened.

Temp Auth dates. If the account has temporary limits in place, the effective dates display.

Reporting hierarchy. If your organization uses reporting hierarchy, the reporting hierarchy information displays.

Comments. If anyone added comments during account setup or maintenance, those comments display here.

Click Back to Managing Account Summary to return to the Managing Account Summary screen.

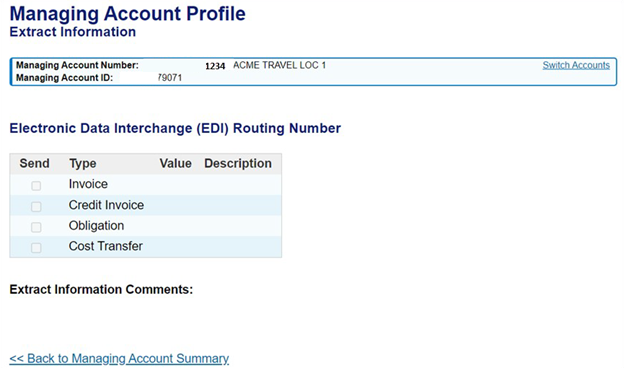

Extract information

The Extract Information screen displays Electronic Data Interchange (EDI) Routing information.

Note any extract information for the managing account, including which extract files types and values the account should receive. The file types and values vary by your unique program setup and payment model.

If anyone added comments during account setup or maintenance, those comments display here.

Click Back to Managing Account Summary to return to the Managing Account Summary screen.

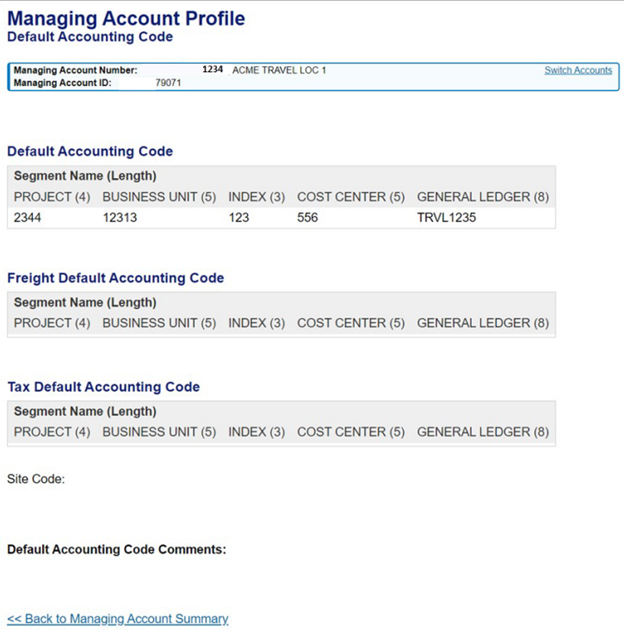

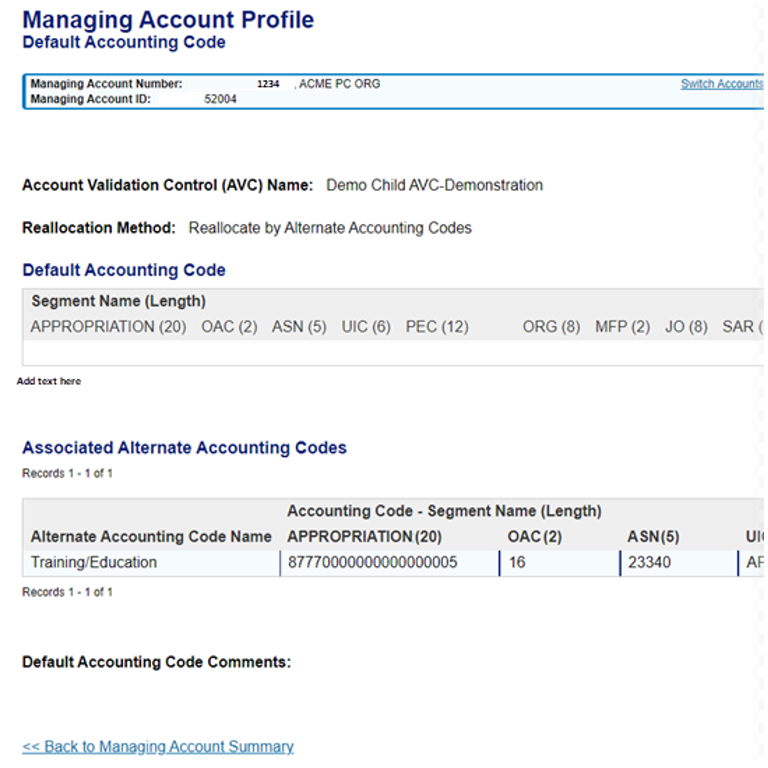

Default accounting code

The Default Account Code screen displays.

The default accounting code assigned to this managing account displays. It applies to all card accounts rolling up to this managing account, unless you put a different one on the cardholder account. Your organization may use additional accounting codes, depending on your program setup.

If anyone added comments during account setup or maintenance, those comments display here.

Click Back to Managing Account Summary to return to the Managing Account Summary screen.

You may see an Accounting Validation Control (AVC) or an Alternate Accounting Code (AAC) attached to the managing account. For more information on AVC and AAC setup and management, refer to the Accounting validation controls user guide. You can also refer to Attach an AAC to a managing account.

Click Back to Managing Account Summary to return to the Managing Account Summary screen.

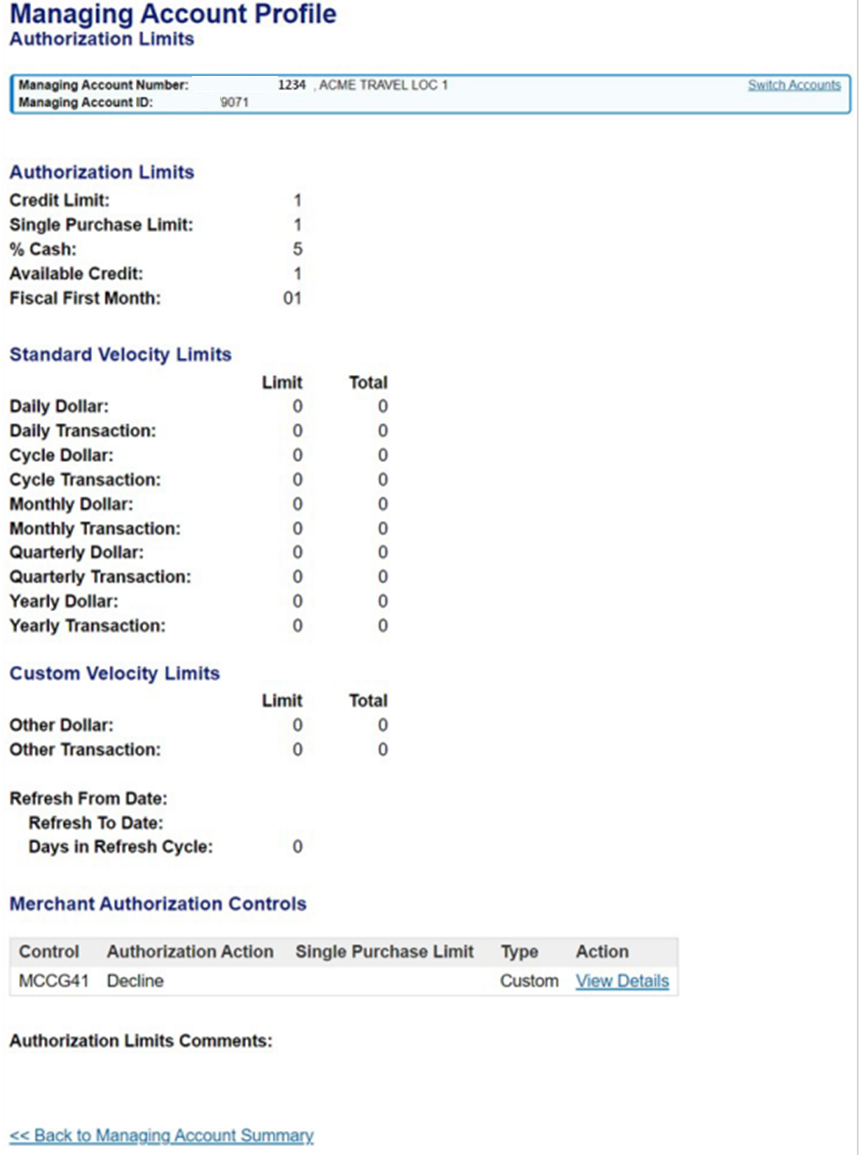

Authorization limits and merchant authorization controls

The Authorization Limits screen displays.

Authorization limits

The credit limit is your overall credit limit for the managing account, including all associated card accounts.

The single purchase limit is the highest amount that a cardholder account can spend on one transaction.

The % cash limit is the percentage of the credit limit that can be used for cash. This reserves the amount for cash and cannot be used for credit.

The available credit is the amount you currently have available for spending. This amount includes all posted transactions through the last nightly system update. The available credit is the difference between your credit limit and outstanding balance. When your payment to the managing account posts, the available credit amount returns to the full amount available.

Standard velocity limits

This lists any daily, cycle, monthly, quarterly or yearly dollar amount or number of transactions limits.

Custom velocity limits

Lists any additional dollar amount or number of transactions limit and time frame.

Merchant authorization controls

Note any merchant authorization controls attached to the managing account. The Authorization Action column indicates what will happen when a transaction is attempted at a merchant with an MCC on the list.

Decline: transactions at the MCCs listed will be declined for all cardholder accounts associated with this managing account.

Approve: transactions at the MCCs listed will be authorized and go through, and transactions at all other MCCs will be declined.

Corporate override: transactions at the MCCs listed will be authorized and go through even if the transaction would put the cardholder account over the credit limit. This is primarily used on travel accounts to avoid having a traveller stranded.

Divert: transactions at the MCCs listed will memo post to the managing account and actually post on a diversion account.

Click View Details to view information about the control, including which merchant category codes (MCCs) are in the group.

Many managing accounts are set up for transactions to decline at merchants that are high-risk of being outside of an organization’s policies. An example would be spend for gambling.

You can put different merchant authorizations (MACs) on a cardholder account so that it works differently from what is on the managing account. When processing a transaction, the system looks first at MACs on the cardholder account and then, depending on your settings, the system looks for MACs on the managing account. You can also select to have the cardholder account use the MACs on the managing account. For more information on MACs on a managing account, refer to the Managing account setup and maintenance user guide. For detailed information on MACs on cardholder accounts, refer to the Cardholder account setup and maintenance user guide.

If anyone added comments during account setup or maintenance, those comments display here.

Click Back to Managing Account Summary to return to the Managing Account Summary screen.

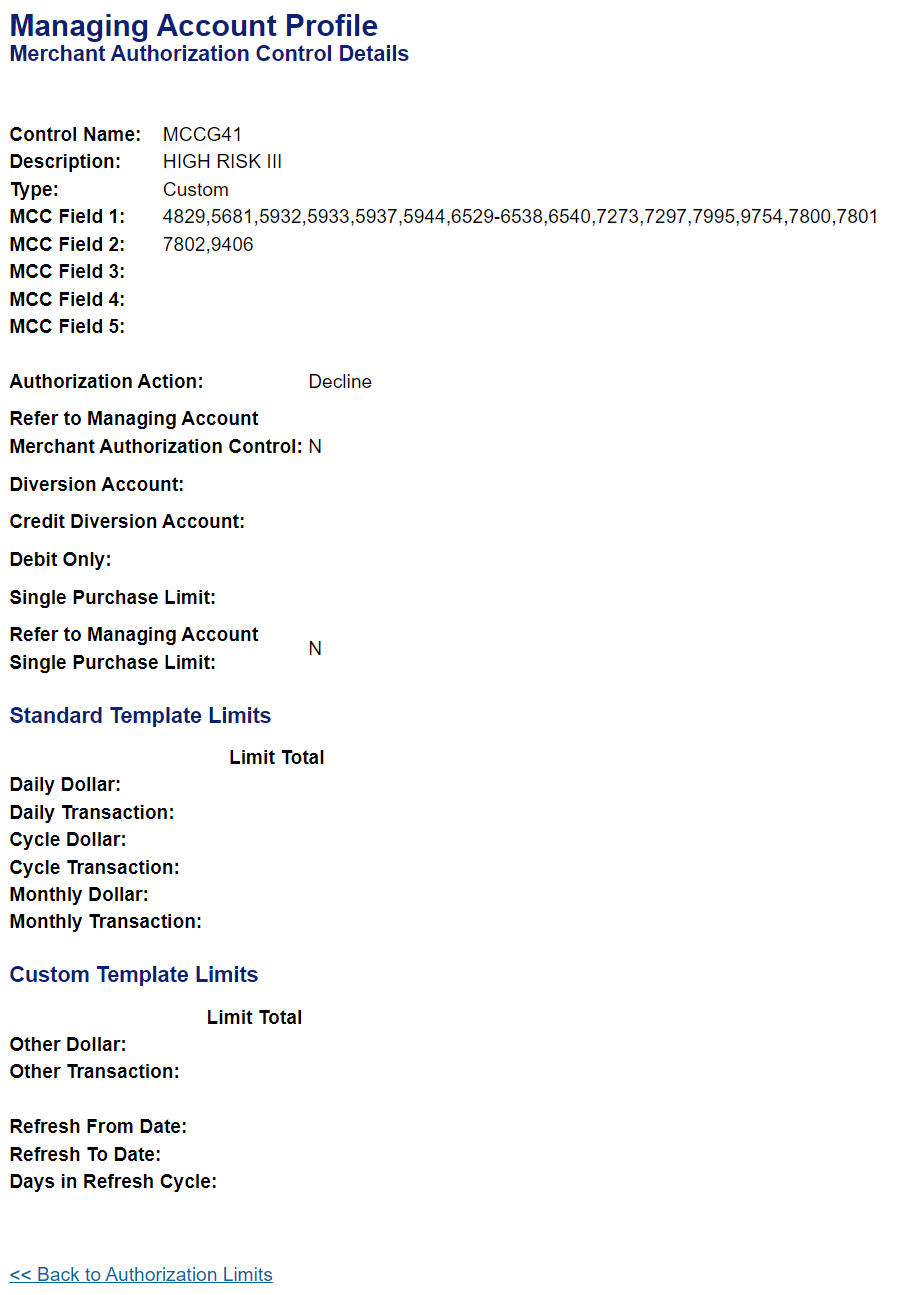

When you click the View Details link, the Merchant Authorization Control Details screen displays.

Review the control details, including MCCs included, authorization action, and limits.

Click Back to Authorization Limits.

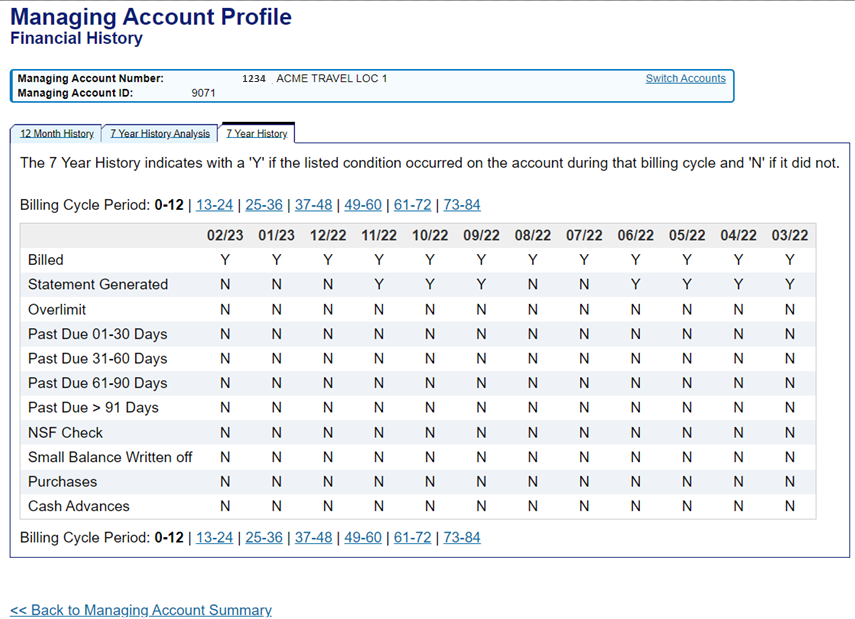

Financial history

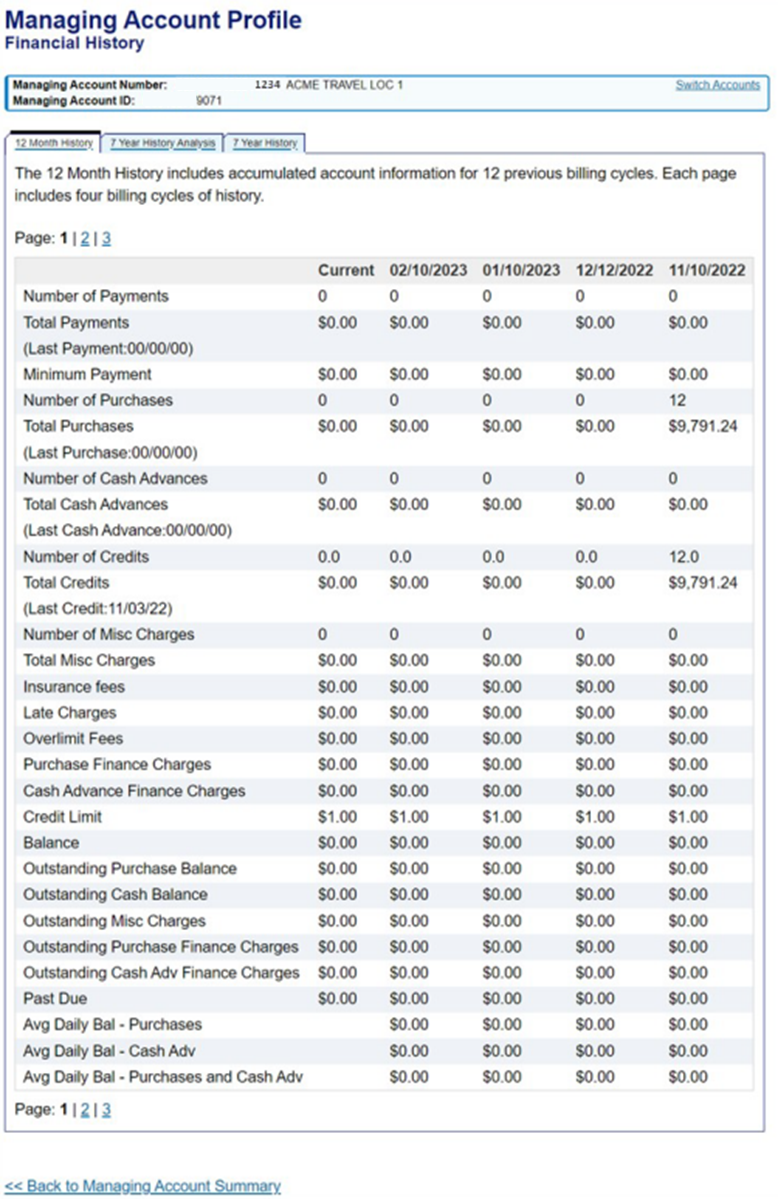

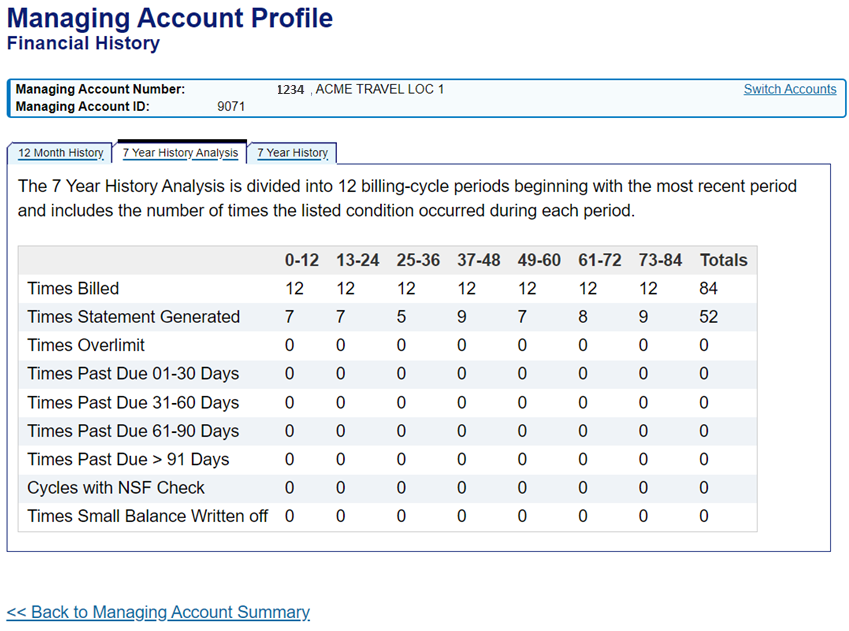

The Financial History screen displays account and payment history.

Click one of the three tabs, 12 Month History, 7 Year History Analysis or 7 Year History to view information. Click a page number or cycle link to see additional information.

12 Month History

The 12 Month History tab shows current information and information for the past 12 billing cycles. The current information is from the last system update and includes only posted information.

Use this screen to see the number and dollar amount of payments made on the managing account.

View summary rollup of the number and dollar amount of all the transactions (purchases), cash advances and credits on all the card accounts rolling up to this managing account.

View the credit limit and balance on the account. The current balance for the managing account is how much of the managing account credit limit your organization has used. This amount includes posted items. This amount does not include pending items.

Look for any past due amounts on this screen. This can help you with reconciliation activities.

7 Year History Analysis

The 7 Year History Analysis tab displays the number of times that listed events occurred during each year (grouped by billing cycle). This is a good place to understand any past due events for the account.

7 Year History

The 7 Year History tab provides a yes/no indication of the listed events by billing cycle/year.

Click Back to Managing Account Summary to return to the Managing Account Summary screen.